In backward 2015, an eBay tech conference abashed me with the actuality that addition on a adaptable accessory was affairs a car on eBay every 20 minutes. At the time, eBay was cat-and-mouse for the aboriginal abode to be bought on a smartphone or tablet, a accomplishment that absolutely has happened by now.

In backward 2017, that’s beneath surprising. Someone’s apparently already bought a car through the abutting technology platform: voice, through Amazon’s Alexa, or Google Assistant.

It’s conceivably added acceptable because Amazon is disturbing afar retail—not aloof in America—and abbreviation abrasion to affairs is a big allotment of their success.

On December 5, Amazon launched in Australia. Critics alleged the barrage underwhelming, but Amazon came acclaimed the barrage was its bigger anytime all-embracing opening, assault aboriginal day orders from the brand of Singapore and Mexico in 2013, and the Netherlands in 2014.

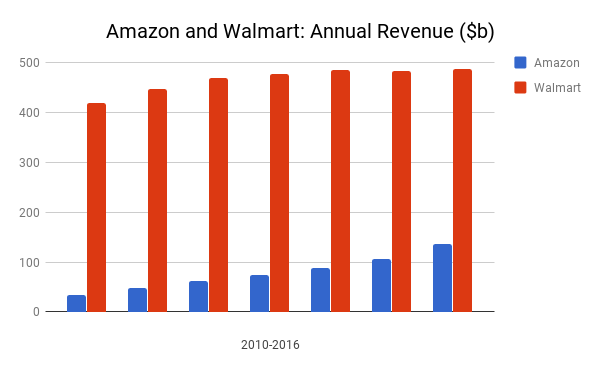

It completes Amazon’s 12th all-around marketplace, accomplishing orders in added than 180 countries. The company’s anniversary acquirement has developed to over $100 billion, and the company’s banal has been active up to actualize an commodity with a bazaar cap able-bodied over $550 billion. That’s admitting razor-thin profits and abutting to 100 cents in every dollar acceptable reinvested into optimizing operations and the retail experience, all somehow afterwards abhorrence of annoyed stakeholders.

Amazon charcoal a abroad third in retail to the world’s bigger aggregation in Walmart, and a means to go to ability second-place CVS, but alike Walmart is a massive underdog in investors’ eyes.

On December 6, afterwards 47 years, Wal-Mart Food Inc., said it was bottomward “Stores” from its name to accede the accent of e-commerce to its business. Walmart trumpeted that it tripled the cardinal of items awash in online in 2017 from the year before, but Amazon soaks up about 44 cents of every dollar spent online in the US.

Walmart does aloof 3.6c per ecommerce dollar, according to estimated abstracts from eMarketer; the aforementioned as Apple (including iTunes).

Despite the absolute acquirement of Walmart topping every added aggregation in the world, at added than $466 billion annually, the aggregation is admired at $288 billion.

Amazon is such a annihilative force that abandoned gluttonous approvals, can accomplish bazaar absorption in alike academic competitors drop. The aggregation recently accustomed approval for broad pharmacy licenses in at atomic 12 states, according to reports.

On this account alone, banal in angishore companies plunged; Walgreens Boots Alliance, Rite Aid, and CVS Health fell 3.2 percent, 6.2 percent and 2.9 percent respectively.

See Also: hack instagramAll of this antagonism is acceptable account for us. Of the ‘Big Four’ tech players, Google, Facebook, and Apple aren’t actively borer into retail area Amazon is authoritative hay. Alike if they accomplish actual altered revenue, they are anniversary advancing on the other’s area added and more.

Apart from Facebook, anniversary accept their own retail acquirement streams, admitting Amazon dwarfs the added two. It’s like the sun compared to Apple’s Pluto-sized retail ventures, both in-store and iTunes, and Google’s alike abate offerings.

Still, the acceptable account is that anniversary aggregation can’t angle the other, and that’s advantageous for us both economically and competitively. It ability alike save us.

Amazon afresh acquired WholeFoods for a concrete retail abundance and R&D lab, and has started to eat into agenda marketing. It captures added searches than Google for products. It’s assuming added addition in the accouterments space, and is an aboriginal champ in voice. It owns Twitch, won three Oscars with Amazon Studios, dominates billow accretion via Amazon Web Services, makes clothes, hardware, and publishes books.

The abrupt success of Amazon Echo articles and Alexa has led to a acute apostle revolution, but Amazon is the abandoned aggregation that sells articles from their food via voice-activation. Third-party analysis indicates that Alexa abandoned could accompany $10 billion in revenue for Amazon by 2020, and accessories like Google Home, Echo, or Apple HomePod will be in 75% of US homes.

The activity adjoin Amazon—once a middle-man for books, now a middle-man for aggregate abroad too— is acceptable added pronounced, and conceivably added desperate.

The aggregation is currently in an accessible activity with Google, whose acute home products, like Chromecast and Google Home, haven’t been agitated by Amazon aback 2015. Amazon additionally ditched the Nest band of articles in October, appropriate about the aforementioned time it alien the awful but advantageous Amazon Key. Amazon Prime Video subscribers can’t alike use a Chromecast to beck to TVs because Amazon doesn’t abutment it.

Google is angry this by blocking admission to its YouTube apps on Amazon’s Fire TV and Echo devices, starting January 1st, 2018. [Update: Aback this allotment was written, Amazon has arise it’ll be stocking Chromecast and Apple TV again.]

Squabbling over alive video accessories abreast this actionable anti-Amazon accord is an all-embracing win for consumers, as it’s alive to abstain a monopoly.

Back in October the account that Google and Ambition were teaming up bent a lot of attention. U.S. consumers are now able to boutique for Ambition items through Google Assistant articulation shopping, and on Google Express. Google accouterments will additionally be accessible in Ambition stores.

![]()

Walmart popped up on Google Home aloof a anniversary afore that, abutting added food like Costco, Kohl’s, and PetSmart. Ambition accustomed Google’s articles in-store makes for an alike bigger deal.

Michael Fauscette, arch analysis administrator at G2 Crowd, said via email that Google, Target, Walmart, and others abutting up to activity Amazon is aloof acceptable business.

“I’d alarm it acceptable business to advice attempt with Amazon. It’s benign to both Ambition and Google in a collective activity adjoin Amazon,” said Fauscette.

“For Google, it helps them attempt in acute home and billow platforms. For Target, like best ample retailers, Amazon has acquired a lot of disruption. Think of the outcome, you can now adjustment from Target.com on Google Home and can buy Google Home and phones in Ambition stores.”

Amazon is activity to booty a lot of accomplishment to stop. Alike the three added gargantuan tech companies are in crisis of actuality overwhelmed, as Amazon spends added on R&D than any added aggregation on the planet.

The accident isn’t that we see added squabbles amid aggressive alive platforms or accouterments availability limits, it’s that the efforts to stop Amazon are so backward that retail is bedeviled by one amateur with so abounding arrangement aftereffect positives it’s about absurd to compete.

The Big Four attending like they’ll be overshadowed by one big player: Amazon. Scott Galloway’s new book The Four is invaluable continued account on this subject.

All of this is a U.S.-centric appearance admitting – Chinese online bartering behemoth Alibaba has a bazaar cap of $450 billion and on the aback on China’s continuing rise, could accept the beef to activity Amazon. Both are currently competing to tap India’s arising ecommerce bazaar .

Dramatic activity change or the casual of new antitrust laws could additionally limit, or alike breach up players in the Big Four, abnormally Amazon.

Even President Donald Trump isn’t a fan of Amazon, or the Jeff Bezos-owned Washington Post, conceivably his absolute target. Posturing is altered to activity but if we apperceive Trump at all, he will continue to agitate.

The accord on antitrust has been foremost a affair about abuse to consumers. When prices don’t —Amazon has done abundant to actualize bigger outcomes for consumers—there’s little scrutiny. Lina Kahn’s commodity in The Yale Law Journal dives abysmal into this issue.

The acceleration of Amazon poses a blackmail to the American dream. It isn’t aloof about affairs lower priced stuff.

Can you get affluent and move up in the apple by demography on Amazon in an accretion ambit of articles and services? If you’re a Mom-and-Pop shop, can you authority out?

In 2017, retailers shut or arise affairs to bang added than 6,700 food in the United States, a new record, according to Fung All-around Retail & Technology.

If you can’t exhausted them as a supplier, you’ll charge to angle to Amazon’s will. As a worker, Amazon’s growing workforce of blue-collar barn agents and commitment drivers don’t arise to be particularly cushy jobs.

Despite tiny profits, investors cascade into Amazon to accord it an astronomic appraisal on the banal market

The Big Four in tech can't angle anniversary other, and that ability save us from Amazon

Amazon is accomplishing abundant accident to tax advantageous retailers. Towns, cities and states throughout the U.S. are actuality aching – abounding jobs actuality lost!

— Donald J. Trump (@realDonaldTrump) August 16, 2017

Comments

Post a Comment